Originally posted in February of 2021, this article has since been updated as of December, 2021.

Let’s start out with a disclaimer: We do not consider ourselves experts on cryptocurrency (or blockchain technology). At the same time, it is our responsibility as advisors to understand enough to identify potential pitfalls and/or opportunities. So, we offer this opinion. Our primary goal in writing this short piece is to cut through the noise and provide some decision logic. We welcome any feedback, questions, or expertise you might offer this discussion. This article focuses on bitcoin, presently the dominant and most widely discussed cryptocurrency. But our comments generally apply to all cryptocurrencies. See important disclosures at the end of this article.

Before we dive into bitcoin, let us acknowledge that we are beginning to understand some of the practical applications of blockchain. Blockchain is the technology on which Bitcoin and others are built. Without getting too technical, blockchain is the reason why bitcoin can be transacted across the globe in seconds, while bank transfers can still take days and can be very costly. That said, this article is intended to cover investments in Bitcoin, not the merits or usefulness of blockchain technology.

Why the increased interest in Bitcoin?

We think there is a lot of hype and FOMO (Fear of Missing Out) baked into it. But there are some high-profile participants in this space that may be feeding the frenzy. For example: In early 2021, Tesla purchased $1.5B of bitcoin and toyed with the idea of accepting it for payment. Given Tesla’s founder Elon Musk’s reputation as an innovative visionary and world-changer, it is not surprising some people want to jump on the bandwagon. Also, more and more large financial institutions, such as US Bank, BNY Mellon, and Northern Trust have announced that they will allow customers to hold and transfer bitcoin, which lends some credibility. In short, these announcements help increase the belief that bitcoin is becoming more mainstream and accepted.

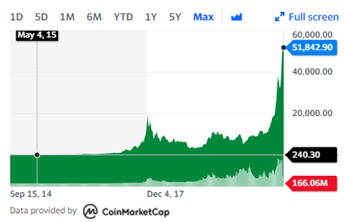

Then there is the simple fact that the price of a bitcoin has increased at breakneck speed from year-end 2018 ($3,742) to 2019 ($7,193) to 2020 ($29,001), and as recently as November, 2021, was priced over $60,000 as reported in Yahoo! Finance (see chart). It is therefore understandable that people are looking around, seeing others who have profited, and wanting in on the action. As with any volatile position, we often don’t hear about those who lost their shirt.

Despite its increased price and growing acceptance, there are still many questions that need to be answered.

Is Bitcoin a currency?

Over time, we have seen more and more use of the term “digital asset” to describe bitcoin and others like it. This implies that perhaps bitcoin has not yet achieved the characteristics most desirable of a currency – low volatility and widespread acceptance. Furthermore, bitcoin is decentralized from the traditional banking system, meaning there is no central bank or government authority to regulate it. Regulation is partially why there is often confidence in traditional currencies. This is not to say there will never be a digital currency with widespread acceptance. In fact, many central banks, including the US Federal Reserve, are actively looking into this very topic.

So, is It an investment?

If we think about more traditional investments, we know, at a minimum, there is a framework for how to value them. For example, we can value a bond based on the income stream it pays the owner. We can value a piece of real estate based on the rental income and we can value a stock based on dividends, expected earnings, etc. There is nothing, as far as we can tell, underpinning the value of a cryptocurrency other than the expectation, or hope, that someone will come along and pay you more than you bought it for. That, to us, is the definition of speculation, not investing. Some people claim that the value of a digital asset is derived from the usefulness of its related blockchain, though we still have a difficult time making the leap to $60,000, in the case of bitcoin.

What are some other challenges with bitcoin?

As we stated earlier, bitcoin is not created or controlled by any government or monetary authority. Therefore, in the US, neither the government nor our central bank are providing regulation over bitcoin. The Securities and Exchange Commission, which regulates the securities industry, does not view bitcoin as a security (they view it as a payment mechanism and store of value) and therefore does not provide regulation either.

Maybe not surprisingly, there is a dark side that comes with the unregulated nature of bitcoin. It has been reported that bitcoin is being used for illegal activities including the drug trade, terrorist activities, and ransomware attacks, with online users looking to hide their identity. In all fairness, there is illegal activity associated with traditional currency too, including the drug trade and money laundering as easy examples. Nonetheless, it seems like a risk worth considering that the government could crack down on bitcoin and other cryptocurrencies, potentially altering some of the fundamentals supporting its allure and current prices.

Another downside of using bitcoin for transactions is taxation. The IRS currently views bitcoin as property, rather than a currency. Therefore, any disposition of it is subject to capital gains taxes, including an outright sale or when using it to purchase something.

The final consideration we will raise here, and this is part of the reason Tesla walked back its interest in bitcoin, is that it takes an enormous amount of computing power to mine. Computing power, in turn, uses electricity, and therefore there is a question about its climate impact. With rising interest in sustainable investing, this could create a conflict of interest for investors.

Final Thoughts

We would be remiss if we did not acknowledge that the first bitcoin ETF (BITO, ProShares Bitcoin Strategy ETF) launched in October 2021 to a great deal of fanfare and the highest launch-day investment total of any ETF, ever. On one hand, someone might ask why you should pay 95 basis points per year for an ETF that is intended to provide exposure to something you can hold for free in a digital wallet. On the other hand, the SEC’s regulatory oversight of ETFs might allay concerns of those who shied away due to the unregulated nature of bitcoin. That’s still not the end of the story, though. The ETF holds bitcoin futures, not bitcoin. So there could be some unforeseen issues there. And we must point out again that bitcoin itself is still unregulated even though its ETF wrapper is regulated. We presume there will be more innovative ways to hold and trade digital assets in the future. But we believe the important question is first to decide whether to participate in it at all, and then figure out the optimal way to access it.

Overall, while there has been increasing interest in bitcoin, we recommend steering clear of it and other cryptocurrencies at this time. Due to the challenges in rationalizing a valuation framework, its volatility, and lack of regulation, we view bitcoin as more of speculation than pure investment. For investors that truly understand bitcoin or simply “want a piece of the action,” it may be acceptable to allocate a nominal amount that would not compromise their ability to attain their financial goals if they lost it, similar to our views on other non-diversified investments. As with most other elements of the investment world, we will continue to monitor this area and welcome any questions, comments, or insight you may have on the topic.

East Bay Investment Solutions is an unaffiliated registered investment adviser. As Co-Chief Investment Strategists, Eric Stein and Mario Nardone are not investment adviser representatives or employees of Morton Brown Family Wealth. East Bay Investment Solutions provides investment consulting and research services to Morton Brown Family Wealth.

For clients who want exposure to cryptocurrencies, including Bitcoin, we advise you to consider a potential investment in corresponding exchange traded securities or private funds that provide cryptocurrency exposure. Crypto is a digital currency that can be used to buy goods and services, but uses an online ledger with strong cryptography (i.e., a method of protecting information and communications through the use of codes) to secure online transactions. Unlike conventional currencies issued by a monetary authority, cryptocurrencies are generally not controlled or regulated and their price is determined by the supply and demand of their market. Because cryptocurrency is currently considered to be a speculative investment, we will not exercise discretionary authority to purchase a cryptocurrency investment for client accounts. Rather, a client must expressly authorize the purchase of the cryptocurrency investment. We do not recommend or advocate the purchase of, or investment in, cryptocurrencies. We consider such an investment to be speculative. Clients who authorize the purchase of a cryptocurrency investment must be prepared for the potential for liquidity constraints, extreme price volatility, and complete loss of principal.

This article contains general information, may be based on authorities that are subject to change, and is not a substitute for professional advice or services. This article does not constitute tax, consulting, business, financial, investment, legal or other professional advice, and you should consult a qualified professional advisor before taking any action based on the information herein. This article is intended for the exclusive use of East Bay clients, and/or clients or prospective clients of the advisory firm for whom this analysis was prepared in conjunction with the EAST BAY TERMS OF USE, supplied under separate cover. Content is privileged and confidential. Information has been obtained by a variety of sources believed to be reliable though not independently verified. To the extent capital markets assumptions or projections are used, actual returns, volatility measures, correlation, and other statistics used will differ from assumptions. Historical and forecasted information does not include advisory fees, transaction fees, custody fees, taxes or any other expenses associated with investable products unless otherwise noted. Actual expenses will detract from performance. Past performance does not indicate future performance.

The sole purpose of this document is to inform, and it is not intended to be an offer or solicitation to purchase or sell any security, or investment or service. Investments mentioned in this document may not be suitable for investors. Before making any investment, each investor should carefully consider the risks associated with the investment and make a determination based on the investor’s own particular circumstances, that the investment is consistent with the investor’s investment objectives. Information in this document was prepared by East Bay Investment Solutions. Although information in this document has been obtained from sources believed to be reliable, East Bay Investment Solutions does not guarantee its accuracy, completeness, or reliability and are not responsible or liable for any direct, indirect or consequential losses from its use. Any such information may be incomplete or condensed and is subject to change without notice.