What is a Market Correction?

Market corrections are defined as the stock market or a specific index dropping in value between 10 to 20 percent. Once it drops below 20 percent, that’s when we would refer to it as a “bear market”. Market corrections are naturally occurring events when the market readjusts and rights itself.

Stock market volatility can feel nerve wracking as an investor. When down days turn into weeks and months, it can feel hard to self-regulate, especially when you don’t have an investment strategy in place. It can feel even harder to maintain perspective if you are attempting to time the market.

What Causes a market correction

If we look at the S&P 500 over the past 70 years or so, we see 36 double-digit drawdowns (total change in price of a stock from one peak to the next valley – indicating the largest loss potential for an investor). The third-longest streak with no corrections over that same 70-year period occurred between 2011 and 2015.

In other words, market corrections happen frequently.

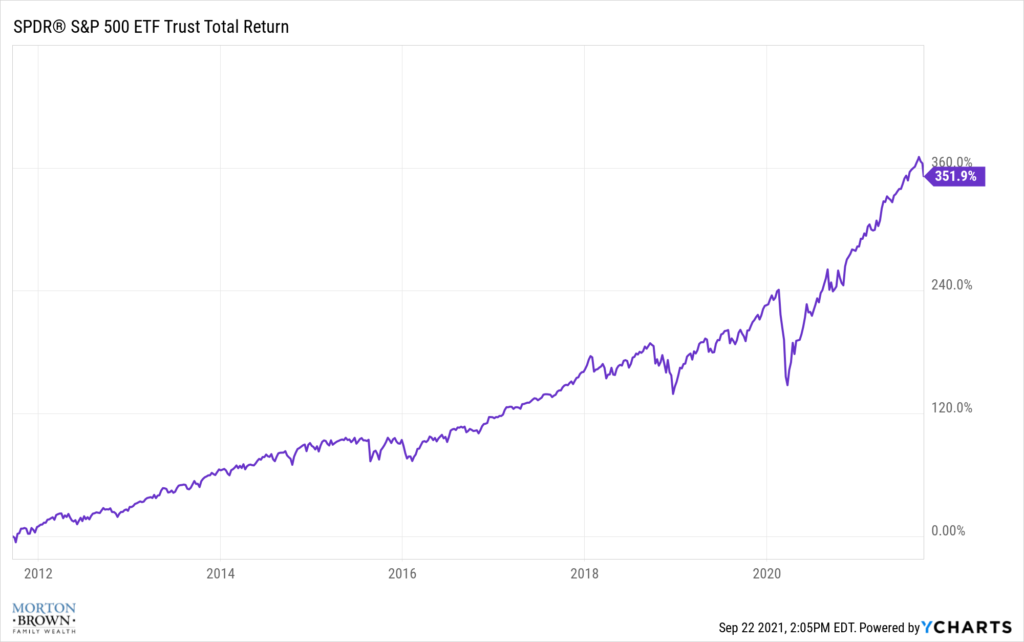

Here is a chart depicting performance of the S&P 500 total returns over the past decade.

To refresh your memory, here is a non-exhaustive list of significant events that occurred during that time period:

- Fiscal cliff and debt ceiling crisis of 2012

- Fed threatening to raise rates and then increasing rates

- Ebola virus

- Two government shutdowns

- Brexit

- Two contentious elections

- The Dow falling 1000 points (and again…and again)

- 20-month period where stocks went nowhere

- 20 percent decline at the end of 2018

- 18 months of a global pandemic

Despite this seemingly daunting list of economic, political, and social events, this chart indicates that the S&P 500 was still up 352% from 2011.

Does that mean the stock market will always be up? Of course not, but it does show that short-term market corrections are not what truly counts in the long term.

What does a market correction mean for my investments?

A market correction does not mean the end of your investment strategy. Your financial advisor should be working with you to ensure your plan and strategy are built to weather natural corrections and have the flexibility to be responsive when it may be something more.

Market corrections also offer opportunities. Down times can provide investors and their financial advisors with a chance to rebalance, tax loss harvest, and implement other strategies based on their unique situations. One example is potentially doing a Roth conversion while account values are lower during a market correction.

In Conclusion…

As a Philadelphia sports team fan, some may say I am a glutton for punishment. My teams have been through more rebuilding years than not. Even when not rebuilding, being a Philadelphia fan can cause stress, anxiety, and heartache like no other team.

One could say similar things about the stock market. Being an investor means looking long-term at performance and goals, rather than short-term wins. Sometimes the market has to breakdown a bit for it to come back stronger.